Assets

21.7%

The Hankey Group

Headquartered in Los Angeles, California, the Hankey Group is comprised of eight operating companies specializing primarily in the automotive, finance, technology, real estate, and insurance industries. Beginning in 1972, the Hankey family acquired a 100% interest in the Midway Ford dealership and guided by the focused vision and unparalleled leadership of its principal, Mr. Don Hankey, the group has undergone a remarkable transformation over the course of the past 50 years.

0000+ employees worldwide

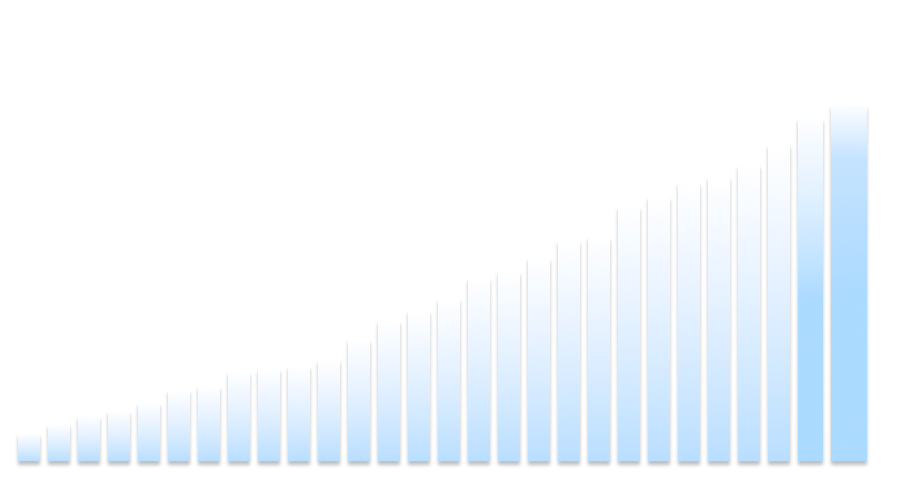

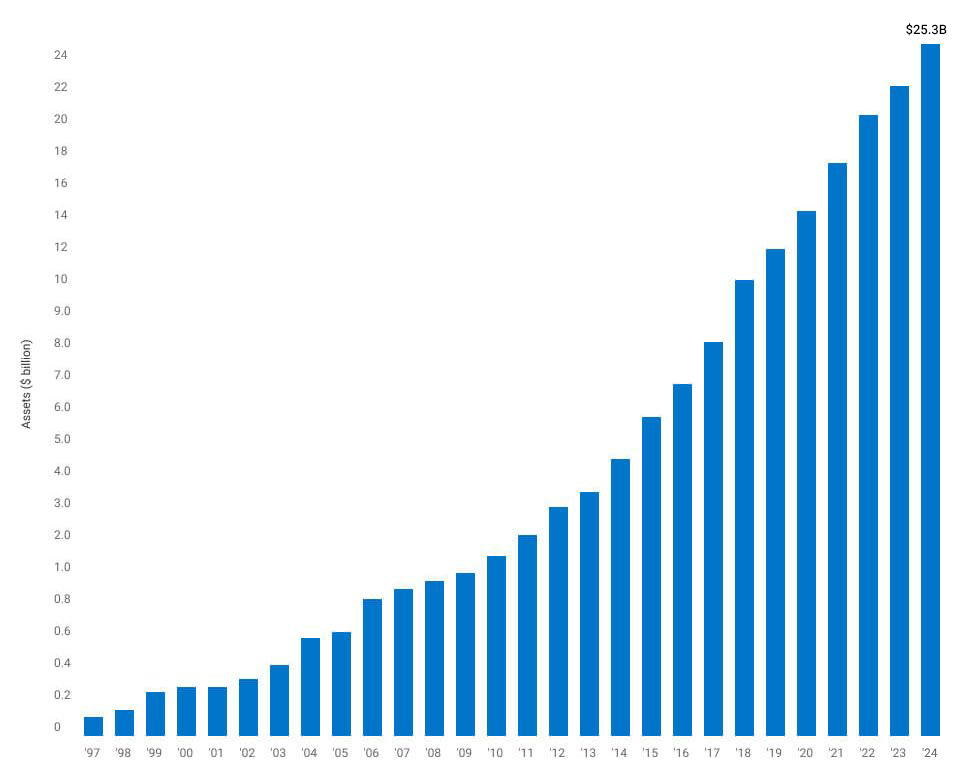

Asset Annual Growth Chart

The Hankey Group strives to maintain an Average Annual Return on Equity of 33% (pre-tax) and an Annual Growth Rate of

20%. This year is projected to be a record year in total assets and revenue. The Hankey Group’s Total Assets are

projected to reach $25.3 Billion as of now.

In 2024

In 2024

-

Assets:

$25.3B

-

Revenues:

$4.8B

Annual Growth Rates Since 1980

Annual Growth Rates Since 1980

-

Assets:

21.7%

-

Revenues:

17.1%

-

Profit:

25.5%

-

Net Worth:

23.3%

-

ROE:

31.9%

-

ROA:

8.6%

Westlake Asset Backend Securitization

Westlake Asset Backend Securitization

(AAA rating by S&P)

-

Issued:

$1.45B

- View more

| 2024-1 WLAKE – $1.51B issued | 2024-2 WLAKE – $1.45B issued | ||

| 2023-1 WLAKE – $1.5B issued | 2023-2 WLAKE – $1.46B issued | 2023-3 WLAKE – $1.65B issued | 2023-4 WLAKE – $1.53B issued |

| 2022-1 WLAKE – $1.516B issued | 2022-2 WLAKE – $1.6B issued | 2022-3 WLAKE – $1.16B issued | |

| 2021-1 WLAKE – $1.50B issued | 2021-2 WLAKE – $1.60B issued | 2021-3 WLAKE – $1.975B issued | |

| 2020-1 WLAKE – $855M issued | 2020-2 WLAKE – $1.2B issued | 2020-3 WLAKE – $1.45B issued | |

| 2019-1 WLAKE – $1B issued | 2019-2 WLAKE – $1.2B issued | 2019-3 WLAKE – $1.3B issued | |

| 2018-1 WLAKE – $1B issued | 2018-2 WLAKE – $1B issued | 2018-3 WLAKE – $1.1B issued | |

| 2017-1 WLAKE – $700M issued | 2017-2 WLAKE – $800M issued | ||

| 2016-1 WLAKE – $450M issued | 2016-2 WLAKE – $550M issued | 2016-3 WLAKE – $625M issued | |

| 2015-1 WLAKE – $395.55M issued | 2015-2 WLAKE – $450M issued | 2015-3 WLAKE – $350M issued | |

| 2014-2 WLAKE – $400M issued |

Major Lines of Credit